Understanding the Culture within the Insurance Industry

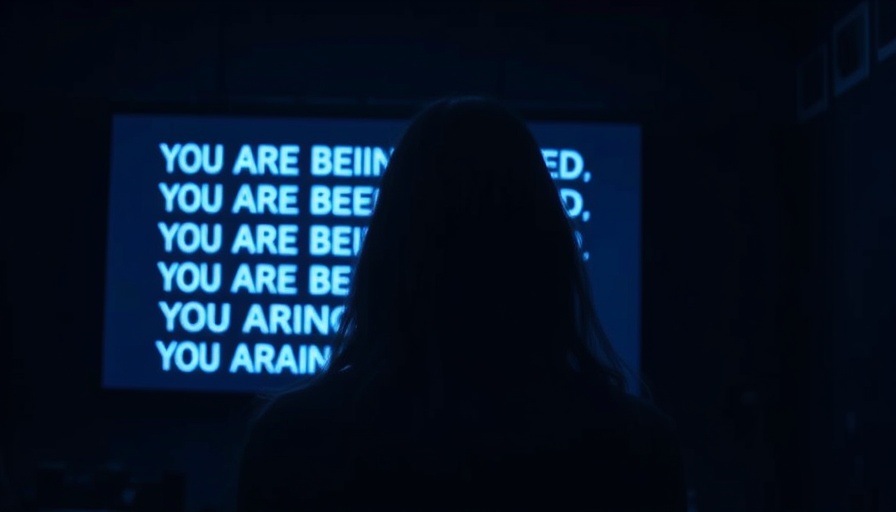

The training documents used by claims adjusters reveal a troubling perspective about public adjusters. As Chip Merlin points out, the industry’s educational framework often depicts public adjusters as adversarial figures rather than partners in the claims process. This bias isn't just a simple misunderstanding; it's a cultural assumption that shapes how insurers interact with policyholders.

From the outset, adjusters are taught to perceive public adjusters as negotiators to be managed rather than cooperative professionals. This systemic issue means that when an individual walks in to advocate for their claim, they might be viewed with suspicion, creating an environment ripe for potential conflict.

Excavating Stereotypes: The Influence of Training

Training scenarios provided by organizations like the Property Liability Resource Bureau (PLRB) highlight the industry's inclination to portray public adjusters as allies to avoid rather than as partners to work alongside. The session outline demonstrates a pervasive mindset that emphasizes aggressive traits that public adjusters supposedly possess. Such perceptions can severely impact the fairness of claims processing.

When claims professionals are trained to bypass public adjusters and engage directly with policyholders to sidestep them, it sets the stage for complications arising during claim adjustments. These biases can lead to unjust outcomes, where the legitimacy of a public adjuster is questioned and their role undermined.

The Danger of Painting with a Broad Brush

One significant concern highlighted by Merlin and echoed by consumer advocates is the risk of stigmatizing all public adjusters based on the misdeeds of a few bad actors. This approach not only harms honest professionals who strive to assist clients but also ultimately jeopardizes the interests of policyholders.

This punitive view could result in delays in securing rightful insurance settlements, potentially affecting those who rely on their policies during times of crisis. When public adjusters are routinely viewed with skepticism, policyholders may not receive the advocacy they need to navigate the claims labyrinth effectively, leading to potential disparities in claim settlements.

Unpacking the Tactics: Insurance Company Profiling

Understanding how public adjusters are framed within training materials offers valuable insights for policyholders. Beyond individual interactions, this training reflects broader strategies employed by insurance companies to maintain control over claims processes and minimize payouts.

By dismissing public adjusters as mere nuisances, insurers foster a culture that routinely sees them as obstacles. This shifts the balance of power, making it crucial for South Carolina residents to be aware of how to protect their rights. Knowledge is a powerful ally in the fight against unfair insurance practices and can illuminate the potentials of effective collaboration.

What Can Policyholders Do?

For South Carolina residents dealing with property damage claims, equipping oneself with the right knowledge is vital. Engaging a public adjuster can provide much-needed support, but the relationship is often thwarted by preconceived biases borne from adjusters’ training. If you’re facing difficulties with your claim or suspect that your insurer may be using bad faith tactics, here are some steps you can take:

- Document Everything: Keep detailed records of all communications and claims processing timelines to build a comprehensive case.

- Seek Expert Guidance: Consider hiring a public adjuster who will work in your best interest to navigate complex insurance policies.

- Know Your Rights: Understanding South Carolina’s insurance laws empowers you to advocate for yourself effectively.

The Path Forward: Advocacy and Awareness

Addressing the biases embedded in insurance claims training requires a concerted effort from both consumer advocates and policyholders. By raising awareness about how adjusters are trained to perceive public adjusters, residents can demystify the claims process and challenge unfair insurance practices.

Final Thoughts: Stand Up Against Unfair Treatment

The insurance industry’s framing of public adjusters as antagonistic figures creates hurdles for policyholders seeking fair treatment. Yet, by becoming informed and advocating for change, you can ensure that such biases do not compromise your right to a fair claims process. As the saying goes, knowledge is power — and in the complex world of insurance claims, it may well be your best tool against unfair practices.

For South Carolina residents navigating this intricate landscape, taking proactive steps can lead to better outcomes in the world of insurance claims. Be vigilant, informed, and ready to challenge any biases that come your way.

Add Row

Add Row  Add

Add

Write A Comment