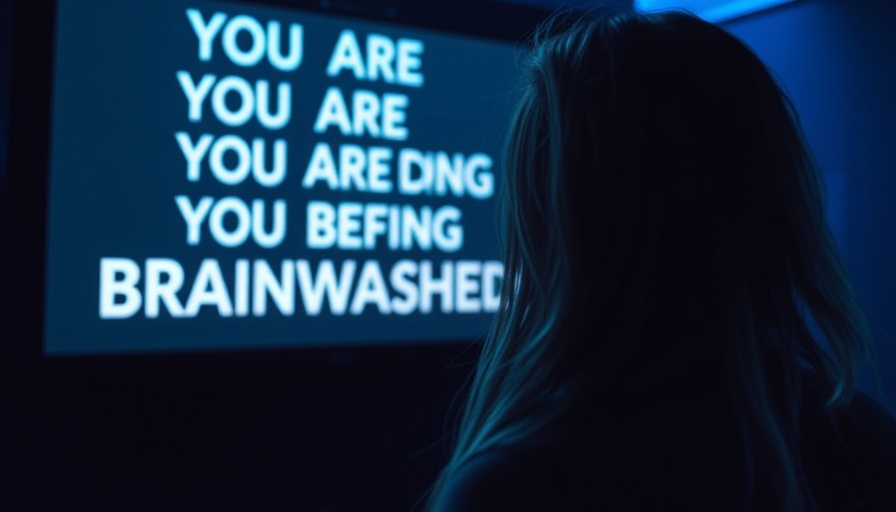

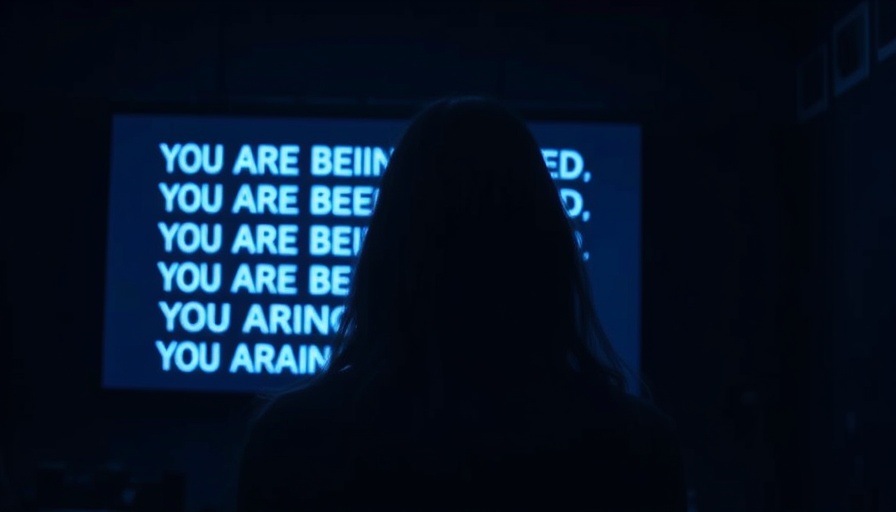

The Underbelly of Claims Training

In a recent address to public adjusters in Dallas, Chip Merlin unveiled the unsettling truth about claims training within insurance companies. From his observations, many adjusters, including seasoned professionals like Chris Faber, had experienced a form of indoctrination that portrayed public adjusters in a negative light. With hands raised in agreement, a significant number of these industry insiders confessed that their training involved role-playing exercises focused on fostering distrust, where public adjusters were depicted as greedy and dishonest. This practice, while seemingly innocuous, has larger implications on how public adjusters are perceived and treated within the claims process.

Understanding the Insurance Culture of Distrust

This negative framing creates a harmful culture of distrust not only among representatives of insurance companies but also among the general public. The message embedded in these training exercises is clear: public adjusters are not to be trusted. Faber's experience at Farmers Insurance highlighted how this culture perpetuates an adversarial relationship between the adjusters and those they are supposed to assist—homeowners navigating the complexities of property damage claims.

The Consequences of Misinformed Perceptions

The implications of such training are profound, particularly for South Carolina residents dealing with property damage claims. When a claims adjuster approaches a case with inherited biases, it can result in unfair treatment and pushback against legitimate claims. For individuals already grappling with loss, this can exacerbate their frustration during a turbulent time. Those seeking compensation for damages may find themselves confronted with an uphill battle, facing tactics designed to minimize payouts or outright deny claims.

Setting a Higher Standard for Public Adjusters

Merlin emphasizes the need for public adjusters to advocate against these practices and hold the profession to a higher standard. By demanding ethical conduct and opposing dishonesty, public adjusters can contribute to a healthier dialogue within the insurance community. The ethical frameworks established by various professional associations already set a high bar for integrity, and it's imperative that the public adjusting community maintain vigilance against fraud in their ranks.

Why This Matters to You

For South Carolinians navigating property damage claims, understanding the dynamics at play in the insurance industry is crucial. Knowing that adjusters often come into positions laden with distrust allows homeowners to prepare accordingly. This knowledge equips policyholders with the confidence to advocate for their rights and potentially contest unfair treatment or claims denials.

What You Can Do Upon Facing a Claim Denial

If you find yourself dealing with an insurance claim denial, approach the situation with the awareness that you are not alone in this struggle. Armed with the knowledge outlined here, consider taking the following steps:

- Document Everything: Keep meticulous records of all communications and claims-related documents.

- Understand Your Policy: Familiarize yourself with your insurance policy details to know what you are entitled to.

- Seek Help: Consider hiring a public adjuster or an attorney familiar with insurance disputes.

These actions can help fortify your position and address the tactics employed by insurance companies.

Emotional Impact of Claim Denials

It's crucial to remember the emotional toll that filing an insurance claim can take. For many, a home isn't just where they live, but a sanctuary filled with memories and personal belongings. When faced with claim denials or settlement delays, feelings of anger, helplessness, and frustration often surface. However, understanding the underlying processes can empower homeowners to combat these feelings and fight back against bad faith insurance practices effectively.

Moving Forward

Having a clear understanding of the tactics employed by insurance companies allows homeowners to navigate the claims process more effectively. Being informed is the first step toward protecting your rights. As a resident of South Carolina facing property damage claims, stay vigilant, and remember that being proactive and knowledgeable can both foster positive outcomes and instill a sense of agency during a challenging time.

By sharing this information among friends and family, you not only empower yourself but also help others in your community protect their insurance rights.

Add Row

Add Row  Add

Add

Write A Comment