The Hidden Reality of Public Adjuster Training

Across the realm of insurance, the training protocols for claims adjusters often resemble more than just a way to administer policies—they can betray an insidious bias against public adjusters. It's a scenario that affects not only public adjusters but also the policyholders who need their services most. Recent insights shed light on this troubling dynamic, particularly for South Carolina residents embroiled in property damage claims.

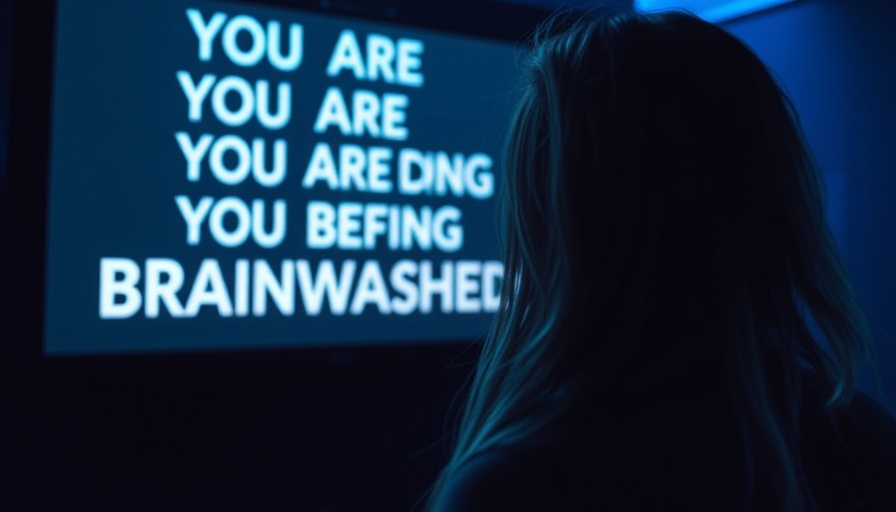

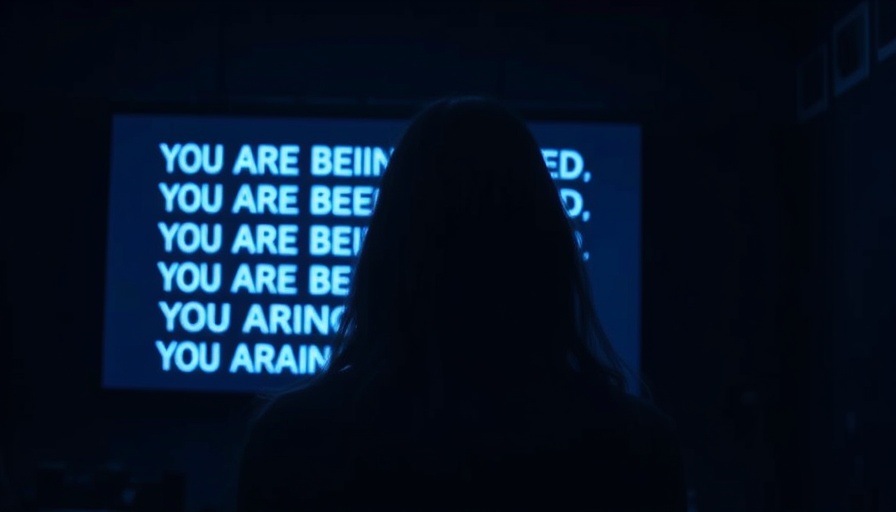

A Closer Look at Insurance Training Materials

Recent disclosures from industry training manuals have surfaced, specifically a session outline from the Property Liability Resource Bureau (PLRB). This document demarcates public adjusters as adversaries that must be effectively managed rather than valuable allies in the claims process. The very language used in these training materials is telling; it implies that public adjusters possess a 'modus operandi' characterized by aggression and dishonesty, frameworks that inevitably influence claims adjusters' interactions with these professionals.

Understanding the Impact of Bias in Claims Management

The cultural conditioning established through such training sets a tone that permeates all aspects of claims management. From the upper echelon of the industry down to frontline adjusters, the perception that public adjusters are inherently adversarial becomes entrenched. This overarching bias not only misrepresents the public adjusters' role but also compromises the very service clients expect and deserve.

Consequences for Policyholders and Adjusters

For residents in South Carolina, this systemic bias manifests in real and tangible ways. Often, public adjusters arrive at claims processes to face hostility fostered by this training, which casts them in a negative light. This lack of cooperation ultimately affects policyholders, as it can lead to suboptimal handling of claims, delays in settlements, and unjust rejections of claims. By normalizing the view that public adjusters are 'the enemy,' the insurance training avoids a crucial collaborative relationship that's vital for a fair claims process.

Learning to Navigate a Bias-Fueled System

Understanding the biases ingrained in the insurance claims process is essential for any policyholder facing property damage. The first step is to acknowledge that the culture within insurance companies is skewed against public adjusters. If you are a South Carolina resident dealing with insurance claims, it is critical to arm yourself with knowledge about how insurance companies often employ tactics designed to sidestep true accountability.

Strategies that you can utilize include meticulously documenting interactions, familiarizing yourself with your rights as a policyholder, and remaining assertive during negotiations. Knowing about the potential for 'bad faith insurance' practices can bolster your defense against deny claims designed to dissuade rightful compensation.

What to Do if Your Claim is Denied

In scenarios where you find yourself facing a denied claim, document everything: every conversation, every promise, and every piece of information exchanged. Engaging a public adjuster could improve your chances since they understand the ins and outs of dealing with aggressive tactics aimed at discrediting them. Moreover, consult resources available through consumer advocacy organizations to strengthen your case and take back control of your insurance journey.

Your Rights in the Claims Process

Being informed about your rights is invaluable in the claims process. Public adjusters are licensed professionals designed to represent your interests. They can help unlock the doors to fair negotiations, pushing back against unfair insurance practices that insurers might employ. Ultimately, understanding both the tactics of the insurance industry and your rights as a policyholder can dramatically shift the leverage in your favor.

For more information on navigating the challenges of insurance claims processes, connect with local consumer advocate groups and familiarize yourself with the claims process as it pertains to South Carolina laws.

Add Row

Add Row  Add

Add

Write A Comment